NEWS

PR COVERAGE REPORT 1OAK JULY 2021

Read More

1-OAK to invest Rs 350 crore to develop residential & commercial project in Ayodhya

Read More

1-OAK to invest Rs 350 crore in developing residential and commercial project in Ayodhya

Read More

Road Ahead in 2021:

Lifestyle Changes and Policy Decisions Propel Housing Demand in Tier-II Cities

Read More

Real estate brands adopted COVID safety protocols

Read More

Realty firms adopt COVID safety protocols

Read More

'Medanta 100 PPE Kits Distribution'

1OAK Donates 100 PPE Kits to Medanta Hospital, Lucknow to Help Fight COVID-19

1. Hindustan Times

2. Rashtriya Swaroop

3. Jansandesh Times

4. Daily News Activist

5. Naydhish

6. Gramvarta

7. 99 acres

8. APN News

9. India Education Diary

Read More

'World Earth Day'

1. Dainik Jagran

2. Rashtriya Sahara

Read More

'Channel Partner Felicitation'

1OAK felicitates channel partners for roaring success of ATMOS; provides AR preview of next project

1. Swatantra Bharat

2. Avadhnama

3. Spasht Awaz

4. Rashtriya Prastavana

5. 99 acres

6. Realty Myths

7. News Patrolling

8. APN News

9. Daily news

10. Realty n More

11. Dainik Bhaskar

12. Dainik Jagran

Read More

'Institutional investment in real estate may rise slightly to USD 5.5 bn in 2018'

Institutional investment in real estate during 2018 could rise marginally to USD 5.5 billion...

Read More

Year Ender 2018: Real estate recovers from double blow of GST, demonetisation

The year turned out to be an eventful one for the Indian real estate marked by the improvement in sales and...

Read More

New real estate trends expected to emerge in 2019

Even though the real estate sector is likely to have a tough year, new trends are expected to emerge

Read More

Housing prices rise by up to 22% in 33 cities during April-June FY19: NHB

For under-construction properties, housing prices went up in 39 cities by up to 17 per cent and...

Read More

Interim Budget sets the stage for revival of real estate

Banking on the initiatives undertaken so far, the government scripts the next chapter for real estate growth...

Read More

'Private Equity Firms Eye Bonanza In Residential Real Estate Space: Report'

The government offered some tax incentives that would benefit both property developers and potential homebuyers...

Read More

'RERA, more demand from buyers drive growth of affordable homes, finds survey'

The survey evaluated the top eight markets of India, including Mumbai, and noted that in other cities...

Read More

'GST Council meets today; levy on under-construction houses may cut to 5%'

In its previous meeting, the GST Council had formed a group of ministers under the chairmanship of...

Read More

Interim Budget sets the stage for revival of real estate

Financial Express, February 4, 2019 4:40 AM

As anticipated, the Interim Budget did turn out to be a vote bank-facing exercise, predominantly cheering farmers and labourers. But the government kept the best for the last—a pleasing boost to the housing sector in more ways than anticipated. The provisions made will certainly boost consumer sentiment, stimulate affordable housing demand and incentivise investors hoping for rental returns.

The major positives included a full tax rebate for income up to Rs 6.5 lakh (including investment under Section 80C), which is likely to push demand for affordable homes, though not much in mid-income segment. There was an extension of Section 80IBA for an additional year; it will push affordable housing and cheer developers active in this segment.

The Budget increased the tax exemption limit for rents earned to Rs 2.4 lakh from the previous Rs 1.8 lakh limit. This will make property investment more attractive and help boost housing sales. Another positive for investors was the rollover of capital gains tax on the sale of residential property. This benefit now applies to two houses instead of the previous single one. Importantly, the Budget provided tax exemption on notional rent of a second home, which again makes property investment more attractive and also gives a fillip to the second home segment.

The period for taxing unsold inventory held by developers has been extended up to two years. As per Anarock data, this will benefit nearly 85,000 ready units that are unsold on the market, of the total 6.73 lakh units across top seven cities. The Budget put a clear onus on boosting infrastructure by allocating more funds for development of airports, railways, etc. While infrastructure deployment doubtlessly benefits real estate industry, it remains to be seen how much of it is actually implemented.

All in all, the real estate sector received its due share of consideration in this balanced Budget, despite the massive electoral pitch. To be fair, the incumbent government has certainly invested heavily into the real estate sector.

Among its achievements, the Narendra Modi government has aptly set the stage for Indian real estate to become a healthy, flourishing industry in the long-term. However, the proviso is ‘long-term’. This government has definitely tightened its grip on real estate, which was the single-largest dumping ground for black money hoarders in previous years.

It has also introduced some high-impact schemes to benefit genuine end-users of real estate. There have been major policy overhauls, amendments in Acts, a visible impetus to infrastructure development, and slightly over-ambitious visions like 100 Smart Cities and Housing for All by 2022.

The triple-policy tsunami of demonetisation, RERA and GST brought about a paradigm shift in the way real estate business is carried out in the country, resulting in vastly improved transparency and efficiency. The confidence of property buyers and investor confidence is now being restored, albeit gradually, and real estate is beginning to look more favourable as an asset class.

That said, the Centre’s aim to enforce RERA in each state is still way behind schedule. As of today, quite a few states have not notified their respective RERA rules as yet, while in others buyers are fretting over the dilution of the rules that have been notified. Also, while the real estate sector braved both GST and demonetisation and will reap the due long-term rewards, they dealt the industry a very hard blow, from which it has not fully recovered yet. In fact, the arrival of a flat 12% of GST on under-construction was not exactly an improvement for buyers.

Certainly, this government has done a lot for the real estate sector, not least of all with its latest Budget. However, the stage that has been set is for long-term growth and not short-term firework displays. Will the momentum that has been infused into the real estate sector continue long enough for a real revival to take place? All eyes are on the forthcoming general elections.

Housing prices rise by up to 22% in 33 cities during April-June FY19: NHB

Economic Times, Jan 03, 2019, 10.01 AM IST

For under-construction properties, housing prices went up in 39 cities by up to 17 per cent and declined in 8 cities by up to 8 per cent and remained stable in 3 cities.

NEW DELHI: Housing prices increased in 33 cities by up to 22 per cent during April-June quarter this fiscal, while rates fell in 14 cities by up to 13 per cent and 3 cities remained stable, according to revised National Housing Bank data with new base year.

For under-construction properties, housing prices went up in 39 cities by up to 17 per cent and declined in 8 cities by up to 8 per cent and remained stable in 3 cities.

The National Housing Bank (NHB), which launched housing prices index 'NHB RESIDEX' in 2007 to track the movement in housing prices on quarterly basis, has revamped the system by changing the base year and releasing separate index for under construction properties.

"NHB RESIDEX has been revamped to include cluster of indices with updated base year, revised methodology and automated processes. The revamped NHB RESIDEX is wider in its geographic coverage...," it said in a statement.

The revamped index captures two housing price indices -- 'HPI@ Assessment Prices for 50 cities and HPI@ Market Prices for Under Construction Properties for 50 cities'. The coverage is spread across 21 states in India.

NHB RESIDEX also includes Composite HPI@Assessment Prices and Composite HPI@Market Prices for Under Construction Properties for 50 cities each.

Till March 2018, HPIs tracked the movement in prices of residential properties on a quarterly basis, taking 2012-13 fiscal as the base year. Now, the base year has been shifted to FY 2017-18.

"Composite HPI@Assessment Prices stood at 83 in June, 2013 and has moved up to 101 in the current quarter i e June, 2018. The index has moved up with a CAGR of 3.8 per cent over the years. The index increased by 2 per cent on YoY (Year-on-Year) basis," NHB said.

City-wise, it said the HPI recorded an overall increase in 33 cities, decrease in 14 cities and no change in 3 cities on y-o-y basis. "Annual growth in HPI ranged from 21.7 per cent in Ranchi to (-) 13.4 per cent in Bhiwadi at the end of the quarter".

Among the 8 Tier-1 cities, Ahmedabad witnessed maximum increase at 12.9 per cent on y-o-y basis, followed by Hyderabad (9.5 per cent), Pune (7.2) per cent and Mumbai (5.2 per cent), Bangalore and Kolkata (2 per cent).

Chennai witnessed no change and Delhi witnessed a fall in index by (-) 4.8 per cent.

Of the 29 Tier-2 cities, NHB said that significant rise in indices was seen in Ranchi (21.7 per cent), followed by Nashik (8.4 per cent), Surat (7.4 per cent) and Vadodara (7.4 per cent), while significant fall in indices was seen in Ludhiana (-12.3 per cent) and Jaipur (-9.1 per cent) on y-o-y basis.

In 13 Tier-3 cities, Gandhinagar (12.8 per cent), Chakan (10.8 per cent) and New Town Kolkata (10.5 per cent) showed significant increase in indices, while Bhiwadi (-13.4 per cent) showed maximum decrease.

In under-construction properties, NHB said that composite HPI@Market Prices stood at 84 in June, 2013 and have steadily moved up to 101 in the current quarter i.e. June, 2018. The index has moved up with a CAGR of 3.6 per cent over the years. On y-o-y basis, the index has witnessed a rise of 3.1 per cent.

City-wise, the HPI recorded an overall increase in 39 cities, decrease in 8 cities and no change in 3 cities on y-o-y basis.

"Annual growth in HPI ranged from 16.9 per cent in Kolkata to (-) 8.3 per cent in Faridabad at the end of the quarter," the statement said.

Annually, all the 8 Tier 1 cities showed growth with Kolkata (16.9 per cent), followed by Hyderabad (6.3 per cnet), Mumbai (4.1 per cent), Delhi (4.1 per cent), Chennai (3.1 per cent), Pune (2 per cent), Ahmedabad (2 per cent) and Bengaluru (1 per cent).

Among 29 Tier-2 cities, the maximum increase in indices was seen in Indore (9.7 per cent) followed by Dehradun (8.3 per cent) and Lucknow (7.5 per cent), while maximum decrease in indices was seen in Faridabad (-8.3 per cent), Thiruvananthapuram (-7.5 per cent) and Vadodara (-3.9 per cent), on y-o-y basis.

In the 13 Tier-3 cities, the variations ranged from 14.4 per cent in Bidhan Nagar to (–) 4.8 per cent in Howrah on y-o-y basis.

New real estate trends expected to emerge in 2019

Live Mint, Thu, Jan 03 2019. 09 59 AM IST

Even though the real estate sector is likely to have a tough year, new trends are expected to emerge

New Delhi: For potential homebuyers, the year 2019 is not expected to be any different from the last few years. Prices are likely to remain stagnant and developers will continue to focus on clearing existing inventory rather than launching new projects as they continue to grapple with regulatory changes like Real estate (regulation and development) Act, 2016 (RERA), goods and services tax (GST) and overall subdued demand.

In fact, 2019 is expected to be another tough year for real estate developers, given the ongoing liquidity problem, owing to the NBFC crisis.

However, even as the scenario remains bleak, some new trends are expected to emerge during the year. Here are a few things you can expect.

Affordable housing

In the last couple of years, affordable housing is the only segment where transactions seem to be happening. The trend is expected to continue in 2019 as well.

“We see an uptick in affordable housing sector—both from supply and demand side—which leads us to believe that it would be a key driver for the residential sector in coming times,” said Shishir Baijal, chairman and managing director, Knight Frank India, a real estate consultant.

Government incentives to both developers and homebuyers are pushing supply as well as demand within the segment. In a recent announcement, the government extended the benefit of Credit Link Subsidy Scheme (CLSS) on home loans for the Middle Income Group (MIG) under the Pradhan Mantri Awas Yojana (Urban) till the end of March 2020. A homebuyer can avail a subsidy of up to ₹2.67 lakh on home loans under this scheme.

“It will prove to be another major push towards the progression of the affordable housing segment. We are confident that this move will set the tone for a prosperous 2019 for the Indian real estate sector,” said Jaxay Shah, president, The Confederation of Real Estate Developers’ Association of India (national), a lobby of private real estate developers.

Co-living options

Co-living is not a new concept, but just got a new name recently. Many people, especially students and young professionals, prefer to share a house or apartment, usually with other students or professionals. Various privately-operated hostels or lodges work on the basic concept of co-living.

While such co-living trends have been around for several years now, they are getting more organised now. “Co-living is more than a mere bed-and-breakfast deal. There are private bedrooms with access to common shared areas like the kitchen and living room. Such spaces offer convenience and an entirely new lifestyle for young professionals,” said Anuj Puri, chairman, Anarock Property Consultants.

However, such co-living options are largely available only in metro cities. “While it is largely major cities like Bengaluru, Mumbai, Gurgaon and Pune that began promoting this concept, the demand for co-living spaces is also gradually percolating to tier II cities like Jaipur and Lucknow where both working millennials and students are increasingly opting for these spaces,” said Puri.

According to a study by Magicbricks, a real estate portal, “Co-living is a fragmented industry with most players being startups having formed in the last 3-4 years. Nestaway, Oyo Living, ZiffyHomes, StayAbobe, SimplyGuest, Placio, YourOwnROOM, RentMyStay, CoHo, CoLive, Stanza Living, Quickr, and Zolo are the key players operating in this space.”

It remains to be seen how this new concept emerges and performs in 2019 and later.

Co-working spaces

As far as commercial real estate is concerned, co-working spaces are expected to strengthen their position in 2019. It was a new concept in India a decade ago, but not anymore. In the last few years, co-working spaces have witnessed a lot of traction and acceptability. While earlier only small businesses and individual professionals opted for it, now even larger companies are occupying co-working spaces.

“A significant change in occupier trends has been witnessed with a marked increase in the collective take up of co-working spaces,” said Ramesh Nair, CEO and country head, JLL India, a real estate consultancy firm.

The share of co-working spaces in total office leasing increased to 10% in 2018 from 5% in 2017. With more supply likely to come in the near future, leasing is expected to intensify in 2019. In addition to strong demand from startups and small and medium enterprises (SMEs), large mainstream corporates are also actively looking at these new-age office spaces, added Nair.

According to CRE Matrix, a real estate research and analytic firm, during the year 2018, Smart Work Business Centre, a co-working space provider rented 18,000 sq. ft to Tata Communication. Similarly, Awfis Space Solutions, rented out 21,000 sq. ft space to Hinduja Global Solutions.

Many experts also believe that the first Real Estate Investment Trust (REIT) will be launched in the country in 2019. REITs was introduced in the year 2008 in India, and first draft guidelines on the subject were issued in 2013. But lack of clarity on tax implication was holding back the REITs to become a reality. But in the last few years, government has removed many hurdles.

“One of the major drivers for the growing interest of investors in the commercial office space has been the government’s move to bring in progressive modifications in India’s REIT policy in last three years, making it more market friendly. As a result, global investors have invested significant capital in acquiring large office assets for building their REIT portfolios in India,” said Samantak Das, chief economist and head (research and reis), JLL India.

Year Ender 2018: Real estate recovers from double blow of GST, demonetisation

Zee Business, Wed, Dec 26, 2018 03:46 pm IANS

The year turned out to be an eventful one for the Indian real estate marked by the improvement in sales and its return to stability after the double blow of GST and demonetisation.

The year turned out to be an eventful one for the Indian real estate marked by the improvement in sales and its return to stability after the double blow of GST and demonetisation. For the sector, the liquidity crunch, the rupee falling to its record low, changes in the Credit Linked Subsidy Scheme (CLSS) and recognition of home buyers as lenders to developers under the Insolvency and Bankruptcy Code (IBC) were other major events during the year.

Although real estate did not witness an increase in launches, developers say, the market registered higher sale of inventory in 2018 compared to last year. "It was a year of stabilisation of reforms implemented in residential real estate over 2016-17. Sales numbers saw 25 per cent improvement over 2017," said Ankur Dhawan, Chief Investment Officer at PropTiger.com.

Data provided by PropTiger.com showed that units sold across the country`s nine major cities in 2018 were around 3.1 lakh, around 25 per cent higher than 2.5 lakh units sold last year. The number of new projects, however, declined this year, with around 1.9 lakh units being launched - 22 per cent lower on a year-on-year basis.

According to market players, growth and demand in the affordable housing segment outgrew the overall demand in Indian real estate in 2018. Mumbai-based Spenta Corportation`s MD Farshid Cooper said: "Affordable housing is doing fantastically well actually. As there is an impetus from the government in terms of taxes etc, that is an added benefit to the segment."

The Centre provides interest subsidy to home buyers belonging to the Low Income Group (LIG) and Middle Income Group (MIG) categories under the Credit Linked Subsidy Scheme of the Pradhan Mantri Awas Yojana.

In June this year, the government increased the carpet area of houses eligible for the interest subsidy by 33 per cent, broadening the ambit of the scheme. The change would be effective from January 1, 2019.

In the new guidelines, the carpet area of a house for Middle Income Group-I (MIG-I) was raised to 160 square metres (sq mt) from 120 sq mt, while it has been increased to 200 sq mt from 150 sq mt in the case of MIG -II.

Speaking of commercial real estate, Cooper said that sale in the segment has performed better than that in residential housing due to demand from investors and funds such as sovereign wealth funds. Non-resident Indian (NRI) investments in the realty sector got a boost this year on the back of a weak rupee.

Rupee was on a slide for months and in October touched its lowest-ever level of 74.47 per dollar. Market participants say investments by NRIs in Indian real estate crossed $10 billion in the current financial year, up from $8.9 billion invested in fiscal 2017-18.

"The (NRI) investments earlier were about 8-10 per cent of the total inventory, but in the current scenario it may rise upto 15 per cent in the near future," Surendra Hiranandani, Director, House of Hiranandani said.

With Real Estate Investment Trusts (REITs) becoming a reality in the near future investments are only likely to go higher, he added. A major headache for the sector this year proved to be the liquidity crunch, which came to light when the lending major Infrastructure Leasing & Financial Services (IL&FS) defaulted on its commercial papers in September.

Parth Mehta, MD of Paradigm Realty said: "The liquidity crunch that is going on currently has given a tough time to the real-estate sector as developer can`t slow down their construction to meet the RERA (Real Estate Regulation and Development Act) timeline and on the other side NBFCs have stopped disbursals even against approved sanctions."

"This liquidity crunch hit both developers and buyers and has led to a slowdown in home buying decisions creating mismatch in housing demand-supply," Mehta said. The RERA implementation was lacklustre across the country during the year, with majority of the states yet to set up a permanent regulator, although most of them have notified the rules.

"Currently 28 states and union territories have notified rules under RERA and 15 of these have established a permanent regulator, the latest one being Delhi, which appointed a full-time regulator in November.

As of November, more than 34,000 projects had been registered under RERA," said Anshuman Magazine, Chairman, India and South East Asia region for CBRE, a global commercial real estate investment company.

In July, the Parliament amended the Insolvency and Bankruptcy Code allowing home buyers to be treated as financial creditors. "Modification in Insolvency and Bankruptcy code to make home buyer a secured creditor was one of the major policy move of government.

This will ensure home buyers are not shortchanged in bankruptcy process," Dhawan from PropTiger.com said. With the liquidity crisis likely to subside with the RBI and the government stepping in, the segment players feel 2019 would see better investment and demand.

The period upto the general elections in 2019 could, however, see caution and subdued interest with the market waiting for a stable government and policies. "2019 will start on a cautious note due to the upcoming elections, but will pick up significant momentum thereafter, in all real estate segments," Hiranandani said.

'Institutional investment in real estate may rise slightly to USD 5.5 bn in 2018'

Economic Times, Dec 26, 2018, 07.36 PM IST

Institutional investment in real estate during 2018 could rise marginally to USD 5.5 billion (around Rs 38,527 crore), as domestic and foreign investors see tremendous growth opportunities in the Indian property market, according to JLL India.

The sector has received investments worth USD 4.2 billion (about Rs 29,413 crore) till October and by the year-end the figure may touch USD 5.5 billion, the highest ever since 2009, the property consultant said in a statement.

Institutional investment in real estate stood at USD 5.42 billion during 2017, it added.

Institutional investments include family offices, foreign banks' real estate investment desks, pension funds, private equity, real estate investor-cum-developer, sovereign wealth funds and foreign corporate groups.

Lending by banks, Non-banking Financial Companies (NBFCs) and Housing FinanceNSE -0.71 % Companies (HFCs) is not included.

"India's real estate sector is at an inflection point. While the investment scenario improved post the global financial crisis, there has been a surge in institutional investments into the sector since the beginning of the year 2014.

"The trend suggests that the market offers tremendous growth opportunities to foreign and domestic investors," JLL India CEO and Country Head Ramesh Nair said.

He said the investment momentum is expected to grow manifold from its current levels considering various factors such as an ongoing policy overhaul, rising investor confidence, enhanced transparency, gradual recovery in housingNSE 0.32 % segment and rising demand for grade A commercial office space.

JLL India released its report 'Institutional Flow of Funds to Indian Real Estate: Trends and Progress' that analyses key trends in institutional investments in the real estate sector over the last decade.

"One of the major drivers for the growing interest of investors in the commercial office space has been the government's move to bring in progressive modifications in India's REIT policy in last three years, making it more market friendly.

"As a result, global investors have invested significant capital in acquiring large office assets for building their REIT portfolios in India," said Samantak Das, Chief Economist and Head of Research and REIS, JLL India.

JLL India is the country's leading professional services firm specialising in real estate with an employee strength of over 10,000. It posted a revenue of over Rs 3,400 crore in 2017-18.

The company is present in 10 major cities (Ahmedabad, Delhi, Mumbai, Bengaluru, Pune, Chennai, Hyderabad, Kolkata, Kochi and Coimbatore).

The consultant provides investors, developers, local corporates and multinational companies with a comprehensive range of services.

'GST Council meets today; levy on under-construction houses may cut to 5%'

ET Now Digital, Feb 20, 2019, 12.10 IST

In its previous meeting, the GST Council had formed a group of ministers under the chairmanship of Gujarat deputy CM Nitin Patel to decide on GST rates on under-construction houses

New Delhi: The GST Council headed by Finance minister Arun Jaitley will hold its 33rd meeting today. As indicated by interim finance minister Piyush Goyal in the interim Budget 2019, the GST Council may slash GST on under-construction houses to 5% and on affordable houses to 3% from the existing 12% and 8% respectively.

Worth mentioning here is that in its previous meeting, the council had formed a group of ministers under the chairmanship of Gujarat deputy CM Nitin Patel to decide on GST rates on under-construction houses. According to a report in the Times of India, the panel has submitted its report suggesting a reduction in the levy.

The reduction of GST rates on under-construction houses is likely to come with the removal of the input tax credit (ITC), which realtors believe will push up prices of these properties. It will, however, result in a reduction in the price of super premium houses of over 10,000 per sq ft where the existing effective rates go up to 10%. The tax on these properties under the new regime will come down to 5% leading to a reduction in the prices, the ToI report said.

The proposal to remove ITC came following complaints that builders are not passing on the ITC benefit to consumers by way of reduction in the price of the property after the rollout of GST. Following these complaints, the GST Council had set up a ministerial panel to suggest ways to boost the realty sector.

'RERA, more demand from buyers drive growth of affordable homes, finds survey'

The Indian Express, Tuesday, Feb 26, 2019

The survey evaluated the top eight markets of India, including Mumbai, and noted that in other cities — including the National Capital Region and the IT hubs of Bengaluru and Hyderabad — also, there has been an improvement in demand for affordable housing.

A SURVEY conducted by Knight Frank India has shown that houses across the country have become more affordable since 2010. This has been attributed to the implementation of the Real Estate Regulatory Act (RERA) and increasing demand from homebuyers, forcing developers to shift from the luxury to the affordable housing sector.

The survey evaluated the top eight markets of India, including Mumbai, and noted that in other cities — including the National Capital Region and the IT hubs of Bengaluru and Hyderabad — also, there has been an improvement in demand for affordable housing.

As per the survey report, there is a decline in the average size of residential units, contributing to growing affordability in the market.

Real estate markets in Mumbai (-25 per cent), Pune (-24 per cent) and Bengaluru (-18 per cent) have seen a sharp reduction in the average size of homes since 2010 while Hyderabad (+4 per cent) and Ahmedabad (+7 per cent) are the only two markets offering larger homes. With annual sales reducing across all major markets, the shift towards making homes more affordable is visible, the report stated.

Annual apartment sales peaked in 2011 and since reduced consistently till 2017. This pushed up the unsold inventory forcing developers to restrategise, especially over the past two years, to entice buyers and move inventory. The establishment of the RERA has further accentuated the need to stick to construction timelines and compelled developers to reduce prices to push sales, the report stated.

Shishir Baijal, chairman and managing director of Knight Frank India said: “Housing is one of the most persistent challenges faced by urban centres today. India, which is also faced with these challenges, however, is witnessing a gradual improvement.

A decline in average ticket size and focus on affordable housing have improved home affordability across the country to a large extent. The fact that affordability statistics have moved dramatically since 2010 explains why sales have improved in 2018.”

He added, “With a focus on creating housing for all by 2022 and to bring back the real demand for housing, improving affordability will be imperative. We can expect further strengthening of affordability in the near future as more affordable and mid-range projects are undertaken.”

'Private Equity Firms Eye Bonanza In Residential Real Estate Space: Report'

NDTV

The government offered some tax incentives that would benefit both property developers and potential homebuyers.

Nation's cash-starved residential real estate market is set to get a boost from foreign and domestic private equity firms, which are lining up big bets worth hundreds of millions of dollars for the sector.

The domestic residential real estate space has been in a rut for years with failed and delayed projects putting buyers off. Developers more recently have been hit by a credit squeeze as banks struggle with bad debts and a crunch in the shadow banking sector.

Private equity firms are now swooping in to buy assets at attractive valuations, say industry insiders, as regulatory changes and a more dovish monetary policy outlook bode well for the sector.

"With major impetus being given to affordable housing ... PE investors are sensing a big opportunity in this segment," said Anuj Puri, chairman at Anarock, a real estate consultancy firm.

"The expected 8-10 per cent annual return in the affordable segment of residential real estate is attracting not just domestic investors but also foreign entities from the US, Singapore and Canada."

Blackstone Group, one of the largest owners of commercial real estate in India, this month agreed to buy a majority stake in Aadhar Housing Finance - an affordable housing project, and committed 800 crore rupees ($112 million) of additional equity to the asset.

Piramal Enterprises and Ivanhoe Cambridge, the real estate arm of Canadian fund CDPQ, last week announced a $70.15 million investment in Palava - a project of Lodha Group on the outskirts of country's financial hub, Mumbai.

Several domestic real estate funds, including HDFC Property Fund and Kotak Realty Fund, are also scouting opportunities in the real estate space, say industry sources aware of the talks.

And one industry source said that Canadian asset management firm Brookfield Asset Management is exploring roughly half a dozen residential real estate investments and it aims to nearly double its bets in the space to over $1 billion, from $450 million in the coming year.

The Abu Dhabi Investment Authority (ADIA), along with Hines Investments is also poised to announce an investment in the space, a source involved in the deal said.

Brookfield declined to comment, HDFC Property, Kotak Realty, ADIA and Hines were not immediately available for comment.

TIMING IT RIGHT

Rising bad debts and real estate project failures have made banks cautious on lending to developers, leading to a slowdown in the property market that relies heavily on borrowing for both home building and buying.

Developers in the country were typically averse to private equity as it is more expensive funding compared to debt they could raise from banks, or non-bank finance companies (NBFCs).

However, with funding from NBFCs drying up in the aftermath of a string of defaults at lender IL&FS, developers are being forced to explore debt and equity funding from private equity.

"For the PE players the valuations are probably a lot more attractive today than they were four to five years ago," said Anshul Jain, managing director at Cushman and Wakefield India.

"From a risk perspective too, risk is slightly lower as some green-shoots are visible in the segment. PE can see that pricing and sale pricing is at an all-time low, so valuations are at an all-time low, so it's a good time for them to enter."

The government has also announced several incentives for the real estate sector in the interim budget earlier this month.

"This is a very positive budget from a real estate point of view," said Samir Jasuja, managing director of PropEquity, an online real estate data and analytics platform.

The government announced a total tax rebate for individuals with annual income of up to 5 lakh rupees, and offered some tax incentives that would benefit both property developers and potential homebuyers.

These measures, along with the rate cut by the central bank last week, are expected to give an added push to the segment.

'Channel Partner Felicitation'

1OAK felicitates channel partners for roaring success of ATMOS; provides AR preview of next project

Highly-acclaimed and International realtor 1-OAK, having made their debut in India with ATMOS, a new age residential project in Gomti Nagar, today expressed their gratitude to all the channel partners for their crucial contribution in making their first project in India a big success in an event at Fairfield Marriott, Lucknow. The senior management also felicitated the participating channel agencies including SMC Realty, 360 Realtors, ICICI Homes, Click Bricks, Sinan Realty, ASA Fincap, Seedwill, Sanskar Properties, 9buy9 Consultants and Smart Infra.

1-OAK’s ATMOS, an exclusive 76 unit project with its unique step configuration balconies and big personal terraces, earned a roaring triumph with 100 percent sale within a very short period from the launch, displaying how residents of tier II cities have been highly under-served when it comes to international quality living spaces. All the channel partners were presented with a certificate along with a special gift to recognize their contribution in making ATMOS a success by the senior management of 1OAK.

“1OAK’s focus in India is largely on transforming the living experience in tier II and tier III cities. Today most of the middle income segment living in the Tier 2 & tier 3 cities of India is well travelled and has experienced an international quality lifestyle. With increasing disposable income there is a yearning for quality lifestyle real estate projects. We have identified a glaring gap in quality of offerings for people living in smaller cities and that’s why we came up with our maiden project ATMOS in India. And, see the result is beyond our imagination. It became an instant hit in a short period of time and has reinforced our understanding of the residential real estate requirements of people in tier II and tier III cities. And, the credit for ATMOS stupendous success completely goes to all our channel partners and we will always be indebted for their hardwork and efforts,” said Mr Sandeep Katiyar, CEO, 1OAK.

The glitterati event also showcased 1OAK’s much awaited upcoming nature themed project – NATURA. The channel partners witnessed the ambience of the Upper Shaheed Path-based project’s state-of-the-art club house as well as the units of the project, which is being designed by country’s leading architectural firm RKA.

“As one of the fastest growing markets, India has been one of the emerging focuses on the company. In India 1-OAK has substantial development rights across multiple locations for developing townships, group housing projects, commercial landmarks, and hotels. With NATURA, we are boasting of contemporary features such as environmental self- sufficiency, an effervescent ambience and at the same time luxury. Natura will again be an exclusive project as we are developing just 272 units. However, based on the requests we received – we also have 2.5 & 3 BHKs in Natura to cater to wider set of our buyers. As we speak, we are already 50% booked in our first tower. We are hoping to garner the same success as ATMOS with this new project,” said Mr Abdullah Khan, COO, 1OAK.

1OAK is a real estate company with a difference which aims at providing class residential and hospitality spaces across multiple countries with innovation and personalization as its core principles. The company is promoted by Singapore based Greenfield Advisory Pte. Ltd. and provides a boutique real estate experience with a portfolio of top notch living spaces in South East Asia, Europe and UAE.

1. Swatantra Bharat

2. Avadhnama

3. Spasht Awaz

4. Rashtriya Prastavana

5. 99 acres Visit Link

6. Realty Myths Visit Link

7. News Patrolling Visit Link

8. APN News Visit Link

9. Daily news

10. Realty n More Visit Link

11. Dainik Bhaskar

12. Dainik Jagran

'World Earth Day'

1. Dainik Jagran

2. Rashtriya Sahara

'Medanta 100 PPE Kits Distribution'

1OAK Donates 100 PPE Kits to Medanta Hospital, Lucknow to Help Fight COVID-19

International real estate firm, 1OAK recently donated 100 PPE kits to Medanta Hospital in Lucknow to help its medical professionals in the fight against COVID-19. As the second wave of COVID-19 strengthens its grip in India, it is efforts like these that are making a significant impact on the way businesses are coming forward to help tackle the unprecedented challenge the country is facing at the moment.

Speaking of the initiative, Mr. Sandeep Katiyar, CEO of 1OAK said “In the war against COVID-19, our healthcare professionals are nothing less than our soldiers. They are constantly fighting for our health and freedom. Frontline healthcare workers which consist of – doctors, nurses, community health workers, midwives and ward boys all play a crucial part in the ongoing fight against the pandemic. Patient safety and healthcare worker safety are inseparable, and our ability to successfully fight off the coronavirus pandemic depends on how well we safeguard our healthcare workers. As a real estate firm that emphasizes healthy, eco-friendly and sustainable living, we feel it’s our responsibility to come forward in such tough times and lend our support to the frontline healthcare workers in every way possible.”

Amid these uncertain times, several businesses along with celebrities are coming forward to extend their support to help people survive through the crisis. It is these efforts that can go a long way in not only beating the virus but also tackle its profound consequences.

Appreciating the efforts by 1OAK, Mr Alok Khanna, Head – Sales & Marketing, Medanta Hospital, Lucknow said “Healthcare workers are working day and night tirelessly to save the lives of those affected with COVID-19. Frontline healthcare workers are at maximum risk and the only way to ensure their safety is through the Personal Protective Equipment (PPE) kits. The government is certainly playing its part by delivering PPE kits to various hospitals around the city, but with the rise in the daily number of cases, there is a huge demand for PPE kits. We really appreciate this initiative undertaken by 1OAK and will greatly help in our fight against COVID-19.”

Adding to this, Mr Saurabh Gupta, VP Operations at Medanta Hospital, Lucknow said, “We really appreciate this initiative by 1 OAK that they thought about the safety of the healthcare workers. If we as a community join hands together just like this and follow all the COVID guidelines, we will soon be able to win this war”

Gaining from its rich experience of real estate development across international cities like London, Singapore, Bangkok, and other places across Thailand, 1OAK launched its flagship project “ATMOS” alongside the Gomti River in One World Township, Lucknow. The real estate firm is also set to launch its next project “NATURA” in the same city which is expected to offer extraordinary living experiences to the residents with the perfect combination of a healthy environment, secure living, facilities and modern infrastructure.

1. Hindustan Times

2. Rashtriya Swaroop

3. Jansandesh Times

4. Daily News Activist

5. Naydhish

6. Gramvarta

7. 99 acres Visit Link

8. APN News Visit Link

9. India Education Diary Visit Link

Realty firms adopt COVID safety protocols

Times of India (Delhi NCR)

Road Ahead in 2021: Lifestyle Changes and Policy Decisions Propel Housing Demand in Tier-II Cities

From changing the way we work and buy to unleashing major shifts in the job market, the COVID 19 pandemic has brought about significant behavioral changes as well as long-term transitions in the economy. The real estate sector, which was one of the worst hit segments in the immediate aftermath of the pandemic. With COVID 19 halting construction as well as buying decisions, a report by KPMG last year had pegged the losses to the real estate sector at Rs 1 lakh crore for the FY 20-21. The lockdowns, pay deferments and increasing opportunities for remote working in the aftermath of a recessionary phase has resulted in significant contraction of residential sales in top tier cities. However, as sales contracted in top tier cities, a shift towards increasing demand in tier II and tier III cities has been observed in recent months. The economic and behavioral changes spawned by the COVID crisis are playing a major role in scripting the evolution of the post pandemic real estate market.

Looking back into the Pre-Covid era, we were already witnessing a change in the real estate demand patterns in the tier 2 & Tier 3 cities of India on back of the changing economic activities. This trend was strengthened by the improving connectivity and infrastructures. With multiple flights connecting these cities & digital infrastructure improving rapidly, several IT & ITeS companies had already started to set up their base. The consumer services companies had started to make inroads to exploit the untapped consumer demand. The increased job opportunities coupled with the lower cost of living had already led many to start shifting their bases away from over-crowded metropolitan cities. Several top-tier developers had already launched international quality lifestyle residential projects to cater to the changing demand patterns. The government’s infrastructure focused schemes like AMRUT and Smart City projects have also helped in developing world class infrastructure in these cities.

Post Covid Surge: Behavioral & Economic Changes

In the post pandemic era, the real estate demand in the tier 2 & tier 3 cities has propelled further. The key factors for this surge can be attributed to the lifestyle changing factors as well as positive externalities created by the steps taken by the policy makers.

The requirements for social distancing post lockdown culminated into the remote working norm and push for ‘work from home’ culture. A lot many companies – having experimented the remote working arrangements, though forced, have been offering their employees either a permanent work-from-home or flexi-work option. There is also a noticeable rise in their hiring of part-time ‘gig’ workers for short duration tenures, further accentuating the remote working phenomenon.

In light of this flexi-work option available & being holed in the smaller apartment of the metro cities, many employees have started to shift their bases to tier-II and tier-III cities where the cost of real estate is lesser. This is giving them an opportunity to live in larger spaces with similar or sometimes even better lifestyle residences. The emergence of better health and education institutions in these cities is further aiding their decision.

Interestingly, many businesses and industrial houses are also shifting their operations to tier-II and tier-III cities in the post pandemic world. Retail giants are establishing warehousing facilities for better last mile connectivity in smaller towns. Several BPOs and ITeS companies are also establishing offices in smaller towns as it helps them reduce business costs while giving them access to a large talent pool. This has created more employment opportunity, locally boosting the demand for housing needs.

Even for the natives of these tier-II and tier-III, pandemic has exposed their need for a lifestyle product. Stuck in their older societies and stand along homes which had little or no common infrastructure – the demand for units in bigger township developments has surged.

While there are lifestyle factors influencing the decision making to shift bases to smaller cities in search for a better quality lifestyle at reasonable prices, the demand for housing projects has been fueled further by enabling policies – most notably the lowering of interest on housing loans and reduction in circle rates and stamp duty across many states. The Reserve Bank of India (RBI) initiated two consecutive repo rate cuts between March and May last year in a bid to enable banks pass on rate cut benefits to consumers and induce greater demand in the economy. This has helped banks offer housing loans at lower interest rates. Currently the interest rate on home loans is as low as 6.65%.

These changes in the macroeconomic in the post lockdown period has helped convert many latent buyers into active ones. The trend is reflected in increased demand for purchase of residential properties in smaller towns and a rebound in real estate sales. A recent survey by NoBroker.com titled ‘India Real Estate Report 2020’ shows 82 percent of respondents plan to purchase a property in 2021. A recent survey conducted by real estate consultant Anarock pointed at a surge in demand for rental housing and purchase in tier-II cities. Clearly, cities such as Lucknow, Indore, Chandigarh, Kochi, Coimbatore, Jaipur and Ahmedabad are emerging as preferred destinations.

Road Ahead in 2021

After a turbulent year the prospects in 2021 look better for Indian realty sector, which is the second largest employment generator. While buying decisions were put off last year, there is a growing sentiment for home ownership among buyers in the post pandemic phase. Also the Govt. has set up Rs 25,000-crore stress fund for stuck projects. A positive buyer sentiment along with favorable policy decisions indicate better prospects for Indian realty sector in coming days – specially driven by the demand pull factors in tier-II and tier-III cities.

1-OAK to invest Rs 350 crore in developing residential and commercial project in Ayodhya

Total cost of the project would be Rs 350 cr of which 20 million USD will be invested by the company and balance will be managed through project accruals.

“Due to the influx of tourists, Ayodhya is going to be a hotspot in the future. We will have the benefit of being an early mover. We plan to develop the project in phases to monetise it in a better manner,” Katiyar told ET.

The company, promoted by Singapore-based Greenfield Advisory Pte. Ltd, which develops residential and hospitality projects, has decided to focus on tier 2 cities in India. It has acquired land in Lucknow, Thiruvananthapuram and Jaipur.

The Uttar Pradesh government has identified 1,100 acres of land in and around Ayodhya for acquisition for planned residential, commercial and retail development. Besides, private developers have started acquiring land for future projects, expecting an increase in demand.

Following the ground-breaking ceremony of the Ram temple, land prices and the number of deals in Ayodhya have surged 50%.

“In the first phase of the Ayodhya project, we will develop 300,000 sq ft while over 400,000 sq ft will be developed in the second phase. Once we acquire the remaining three acres, additional development will be taken up,” said Katiyar.

The company has planned a high-street concept for retail development while residential societies will be mid-rise.

“We have an aggressive plan of development across India and we are already getting a good response for our existing projects,” said Katiyar.

The company’s focus in India is largely on transforming the living experience in tier 2-3 cities where increasing disposable incomes and ease of living have opened up the luxury housing segment.

Greenfield Advisory, which provides investment platforms to institutional and accredited investors, will infuse funds in the project.

As per estimates of the Ram Temple Trust, the Ram temple, once ready in 2022, could see 80,000 to 100,000 visitors daily.

Property prices in the city were estimated to have shot up 25-30% in 2019 immediately after the court verdict that paved the way for the building of the Ram temple.

1-OAK to invest Rs 350 crore to develop residential & commercial project in Ayodhya

Total cost of the project would be Rs 350 cr of which 20 million USD will be invested by the company and balance will be managed through project accruals.

“Due to the influx of tourists, Ayodhya is going to be a hotspot in the future. We will have the benefit of being an early mover. We plan to develop the project in phases to monetise it in a better manner,” Katiyar told ET.

The company, promoted by Singapore-based Greenfield Advisory Pte. Ltd, which develops residential and hospitality projects, has decided to focus on tier 2 cities in India. It has acquired land in Lucknow, Thiruvananthapuram and Jaipur.

The Uttar Pradesh government has identified 1,100 acres of land in and around Ayodhya for acquisition for planned residential, commercial and retail development. Besides, private developers have started acquiring land for future projects, expecting an increase in demand.

Following the ground-breaking ceremony of the Ram temple, land prices and the number of deals in Ayodhya have surged 50%.

“In the first phase of the Ayodhya project, we will develop 300,000 sq ft while over 400,000 sq ft will be developed in the second phase. Once we acquire the remaining three acres, additional development will be taken up,” said Katiyar.

The company has planned a high-street concept for retail development while residential societies will be mid-rise.

“We have an aggressive plan of development across India and we are already getting a good response for our existing projects,” said Katiyar.

The company’s focus in India is largely on transforming the living experience in tier 2-3 cities where increasing disposable incomes and ease of living have opened up the luxury housing segment.

Greenfield Advisory, which provides investment platforms to institutional and accredited investors, will infuse funds in the project.

As per estimates of the Ram Temple Trust, the Ram temple, once ready in 2022, could see 80,000 to 100,000 visitors daily.

Property prices in the city were estimated to have shot up 25-30% in 2019 immediately after the court verdict that paved the way for the building of the Ram temple.

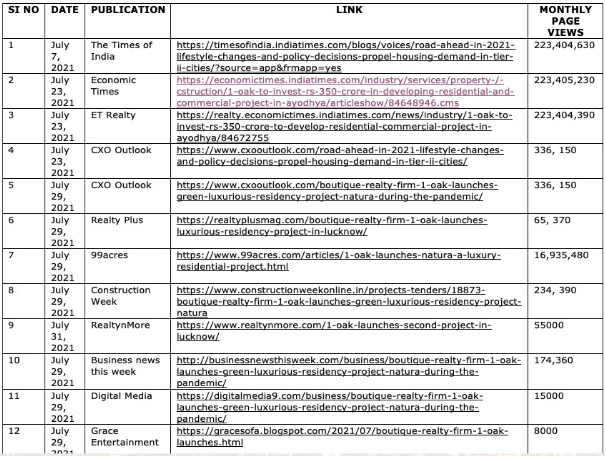

PR COVERAGE REPORT 1OAK JULY 2021

Key Deliverables

Number of Coverage: 18- • Print: 12

- • Online: 06

- • Dainik Bhaskar

- • Economic Times

Total cost of the project would be Rs 350 cr of which 20 million USD will be invested by the company and balance will be managed through project accruals.

“Due to the influx of tourists, Ayodhya is going to be a hotspot in the future. We will have the benefit of being an early mover. We plan to develop the project in phases to monetise it in a better manner,” Katiyar told ET.

The company, promoted by Singapore-based Greenfield Advisory Pte. Ltd, which develops residential and hospitality projects, has decided to focus on tier 2 cities in India. It has acquired land in Lucknow, Thiruvananthapuram and Jaipur.

The Uttar Pradesh government has identified 1,100 acres of land in and around Ayodhya for acquisition for planned residential, commercial and retail development. Besides, private developers have started acquiring land for future projects, expecting an increase in demand.

Following the ground-breaking ceremony of the Ram temple, land prices and the number of deals in Ayodhya have surged 50%.

“In the first phase of the Ayodhya project, we will develop 300,000 sq ft while over 400,000 sq ft will be developed in the second phase. Once we acquire the remaining three acres, additional development will be taken up,” said Katiyar.

The company has planned a high-street concept for retail development while residential societies will be mid-rise.

“We have an aggressive plan of development across India and we are already getting a good response for our existing projects,” said Katiyar.

The company’s focus in India is largely on transforming the living experience in tier 2-3 cities where increasing disposable incomes and ease of living have opened up the luxury housing segment.

Greenfield Advisory, which provides investment platforms to institutional and accredited investors, will infuse funds in the project.

As per estimates of the Ram Temple Trust, the Ram temple, once ready in 2022, could see 80,000 to 100,000 visitors daily.

Property prices in the city were estimated to have shot up 25-30% in 2019 immediately after the court verdict that paved the way for the building of the Ram temple.